Traditional IRAs and Roth IRAs

Assistance navigating contribution rules, tax treatment, and planning considerations for individual retirement accounts.

Plan Design, Spin-Offs, and Mergers

Legal guidance on retirement plan design and structural changes arising from corporate transactions.

SEPs

Advisory support for Simplified Employee Pension plans, including eligibility, contribution mechanics, and employer considerations.

New York Secure Choice Act

Information and guidance on employer obligations and considerations under New York’s state-facilitated retirement program.

Multiple Employer Plans

Advisory services related to retirement arrangements covering multiple employers under a shared plan structure.

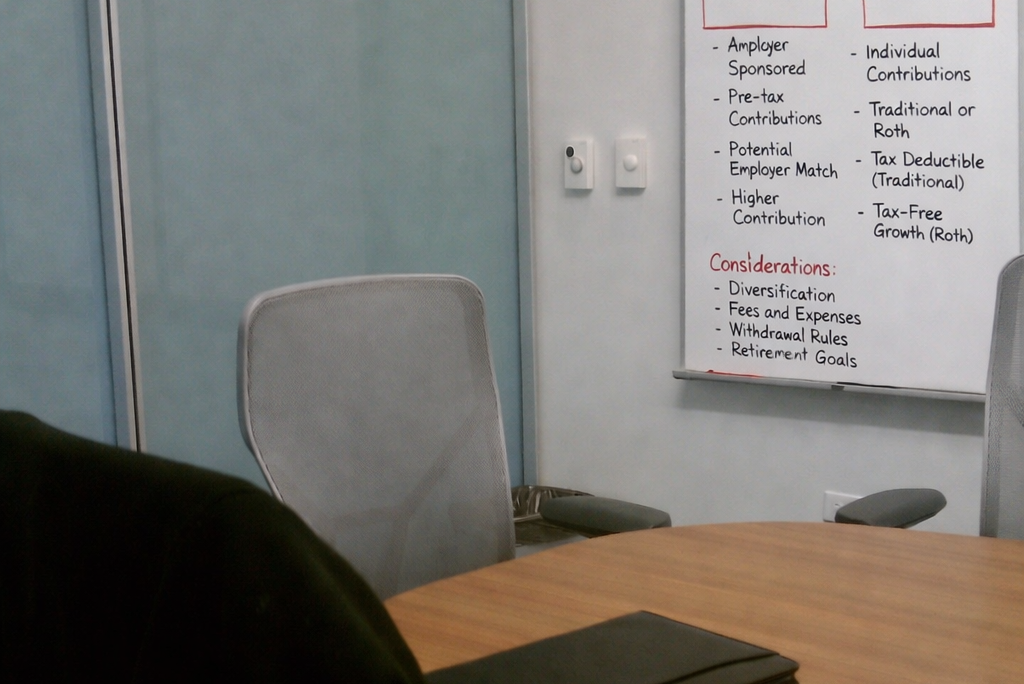

401(K) & Other Defined Contribution Plans

Guidance on the structure, administration, and compliance considerations of employer-sponsored defined contribution retirement plans.

IRS Plan Correction & Audits

Support in addressing plan errors, correction programs, and interactions with regulatory authorities.

Plan Document Compliance Service

Review and maintenance support to help ensure plan documents align with current regulatory requirements.

SPDs & Communications

Assistance with summary plan descriptions and participant-facing retirement plan communications.